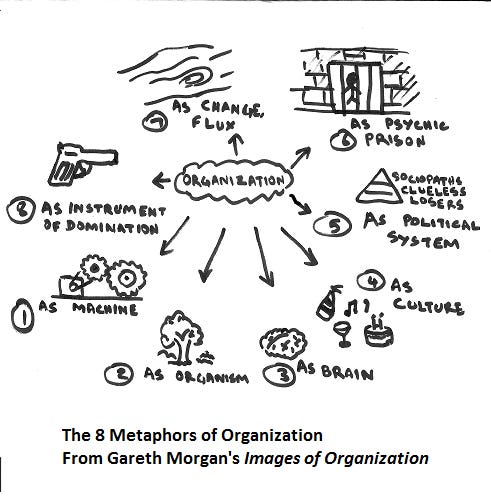

In the year 1986, Gareth Morgan published his landmark best-seller book, "Images of Organisation", which explored a simple, but powerful question: What does it take to see an organisation through various metaphors?

<Image Credits: Ribbonfarm>

The premise of the book looks deceptively simple - until you think deeper about it.

What we think about what an org…